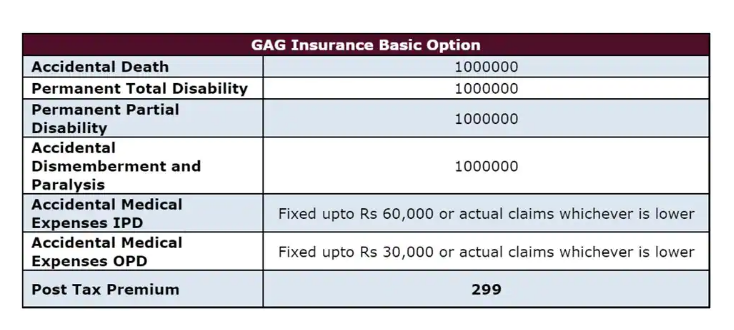

India Post's Rs 299 Basic Insurance Plan

IPPB offers Rs 10 lakhs in accidental death or permanent entire disability, permanent partial disability, and accidental dismemberment and paralysis as part of their Rs 299 basic insurance plan. However, unlike the premium Rs 399 plan, this insurance does not include advantages such as Education Benefit, In-Hospital Daily Cash, Family Transportation advantages, and Last Rites Benefit. The Rs 299 plan, on the other hand, provides Rs 60,000 in case of accidental medical expenditures in IPD and Rs 30,000 in case of accidental medical expenses in OPD.

- Accidental Death: It covers death as a result of an accident that occurs within 365 days of the accident date. The coverage limit is set at 100% of the Sum Insured.

- Accidental Dismemberment and Paralysis: It covers permanent dismemberment that happens within 365 days of the accident date. As a result of an injury, paralysis is the loss of the capacity to move (and occasionally feel anything) in part or all of the body.

- Education Benefit: In the event of accidental death or permanent complete disability, the whole sum insured is payable. Benefit is payable to an eligible kid who is enrolled full-time in any institution.

- Permanent Total Disability: It covers Permanent Total Disability that occurs within 365 days of the accident date. The coverage limit is set at 100% of the Sum Insured.

- Permanent Partial Disability: It covers Permanent Partial Disability that occurs within 365 days after the accident date. The coverage limit is given in the policy text as a percentage.

To mention a few exceptions, the Post Office Accident Insurance policy does not cover suicide, military services or operations, war, criminal conduct, bacterial infection, sickness, AIDS, or risky sports.

How to Purchase Policy online? Check on India Post Official Website Click Here

Work from home Jobs Available Check and Apply Click Here

Top Social Media Groups Every Professionals And Marketer Should Join Check Now